Don’t Kill the Golden Goose!

By Jenny C. Servo, Ph.D.

In July 2022 Congress passed the sweeping Domestic Semiconductor Manufacturing Act[1] to ensure U.S. competitiveness and dominance in this critical technology. This need harkens back to the 1970’s when the same concern regarding U.S. competitiveness gave rise to the Small Business Innovation Research (SBIR) program. However, the response today is different – in 2022, Congress is heading towards the potential lapse of the SBIR/STTR programs due to its inaction!

What is so unnerving is that Congress apparently doesn’t know the role that the SBIR/STTR programs have already played in strengthening the domestic semiconductor industry – through a small, SBIR-funded company called Arkansas Power Electronics International (APEI) which was acquired by Cree (NASDAQ: Cree) in 2015 and today is known as Wolfspeed. The future of the semiconductor industry lies with wide band gap materials – SiC and GaN and Wolfspeed is the world leader.

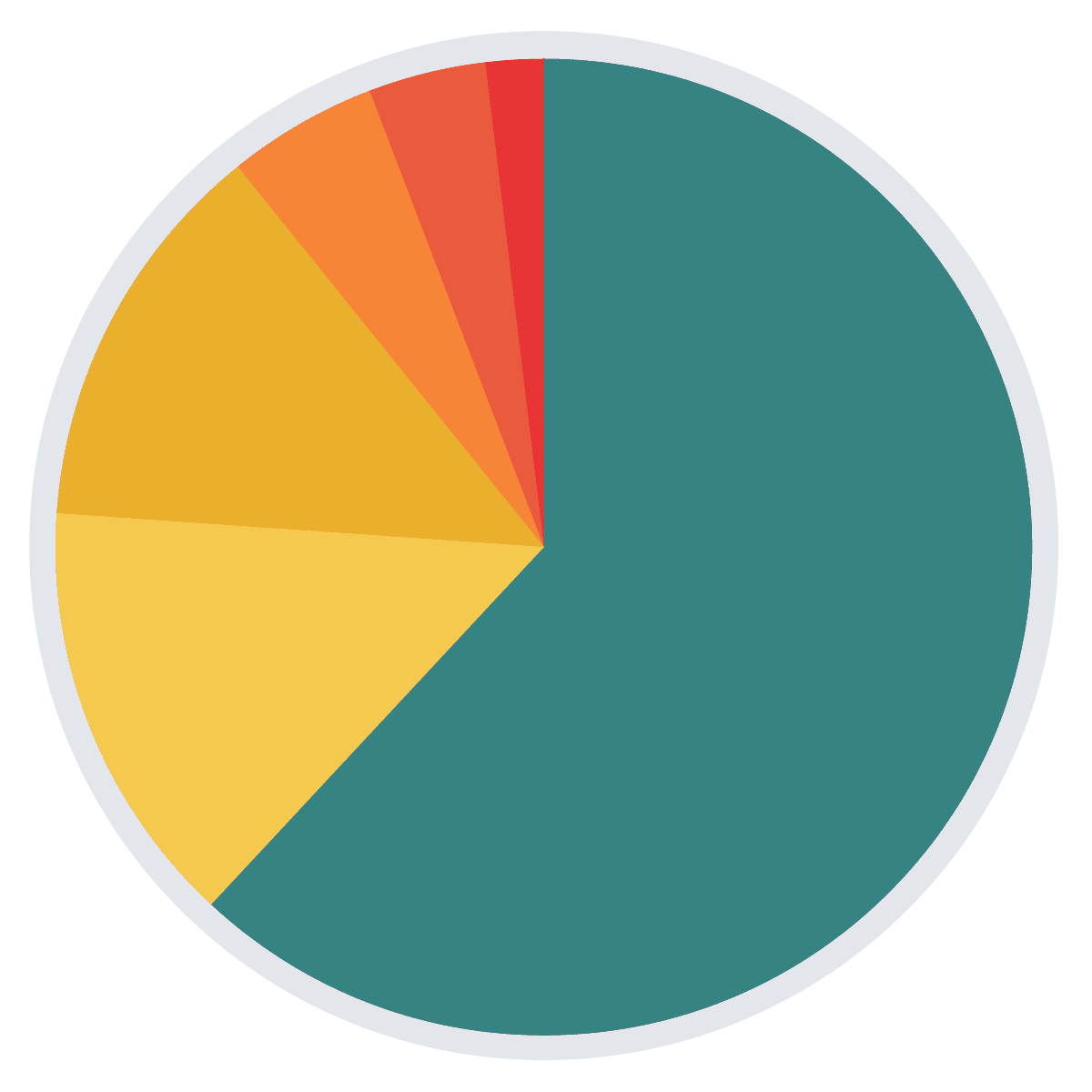

SiC Wafer Market Share

- Wolfspeed

- II-VI

- SiCrystal

- SK Siltron

- TankeBlue

- Others

Source: Wolfspeed, pg 80.

At the time APEI was acquired in 2015, the Executive Vice President of Cree stated,

“Adding this expert team of innovators and portfolio of patents will enable us to further disrupt and expand the market,” said Frank Plastina, executive vice president, Cree Power and RF. “Extending our research and development capabilities with APEI, a leader in wide bandgap power R&D, will help us accelerate delivery of a full spectrum of SiC power modules to meet customer requirements for performance and cost.”[2]

Two days ago Wolfspeed announced a ”$5 Billion investment in Chatham County, largest in NC History”[3] to build a new semiconductor plant.

To put the role of the SBIR program in perspective here are a few data points. Arkansas Power Electronics International was founded in 1997 and between 2002 and 2015 received 59 Phase I and Phase II awards which included: 29 awards from the Department of Defense; 13 awards from the Department of Energy, 14 awards from the National Aeronautics and Space Administration, one award from the Department of Transportation and one award from the National Science Foundation. This level of support for revolutionary technologies by the SBIR/STTR programs is necessary. To simply assume that providing multiple awards to a small business is a waste of tax-payer money or that this practice prevents other companies from winning SBIR/STTR awards is simply false.

This is one of the many SBIR/STTR successes that goes unheralded as federal agencies lack sufficient funding and tools to track the success of SBIR/STTR awardees over an extended timeframe. Since 1982, many successful technologies funded though the SBIR/STTR programs have enhanced U.S. competitiveness, created jobs, and commercialized new products. Congress needs to take appropriate measures immediately to keep the SBIR/STTR programs in place. To let this program lapse will hinder U.S. competitiveness – which is the reason the SBIR program was initially created [4] and should be allowed to flourish!

[1] H.R. 6359 – Investing in Domestic Semiconductor Manufacturing Act

[2] Wolfspeed. “Cree Acquires APEI (Arkansas Power Electronics International, Inc.” July 09, 2015.

[3] WRAL News. Wolfspeed announces $5 billion investment in Chatham County, largest in NC history”, September 9, 2022.

[4] Public Law 97-219 – July 22, 1982.

Jenny C. Servo, Ph.D. is the President and Founder of Dawnbreaker, a woman-owned small business located in Rochester, NY which has provided commercialization assistance to SBIR/STTR awardees since 1990.